Digital Inheritance: Can You Bequeath Your Account?

A footprint in the virtual world…

Often modern man values “likes” icons for their weight in gold. Attention — the question: is it possible to bequeath your accounts on social networks along with all the “like” marks, photos, and videos from vacations, with the fruits of nocturnal insomnia — poems? And, what is much more relevant, is it possible to leave grateful descendants their electronic wallets with money, access to e-mail, messengers, cloud storage, etc.?

Indeed — today many of us use social networks and online services, often several. Their owner’s relatives would like to retain access to them even after his death. No wonder — accounts on different platforms store money, photos, and videos. Some services allow you to bequeath an account.

However, not everything can be left as an inheritance. In this case, you can resort to a common legal tool — a will.

But even here there are peculiarities. It is possible, of course, to use the online page of a deceased relative unofficially, but for this, you may face punishment.

What are digital assets?

To begin with, let’s understand — what are digital assets? They include domain names, online accounts, digital wallets, email accounts, and other virtual assets.

So, a digital asset is any object of value that exists in digital or computerized form. All together, your digital assets are referred to as a “digital identity” and this virtual property may well be inheritable.

The legal status of these objects is not yet fully defined. For convenience, some experts suggest dividing all Internet property into three types:

- Rights to use digital services (access to a social network or online movie theater);

- Analogs of money (e-wallets, cryptocurrencies, money on an account in an online game);

- Objects of intellectual activity (texts, audio and video recordings).

What is Digital Legacy?

Digital Legacy is a collection of electronic data that a user leaves behind on storage media and the internet after death. These assets are firmly embedded in our lives, but their inheritance is hardly regulated by laws in most countries. Nor is there an official list of data that can be inherited. Therefore, if a person wants to access a deceased person’s page, they are likely to face a lot of problems.

In 2012, a family from Berlin sued one of the popular social networks, trying to enter the account of their deceased daughter. Parents wanted to see correspondence and records to understand the reasons for what happened. Only after 6 years of legal proceedings the relatives get access: the highest court of Germany ruled that accounts in social networks are not different from letters or diary entries.

This is how the jurisprudence emerged in Europe that digital accounts can be inherited.

What about privacy protection?

IT companies look at digital assets differently. We should not forget that this is personal data that cannot be transferred to third parties without the owner’s permission. In addition, the deceased person’s interlocutors may not have consented to disclosure.

Another important nuance is that digital services provide their products as a temporary service, and services cannot be inherited. Why not, though? — After the death of a mother, can’t a hairdresser be “inherited” by her daughter?

The same goes for messengers. They are strictly tied to phone numbers, which (at least for now) are not subject to inheritance rights. Access to chat rooms also violates the secrecy of third-party correspondence.

Accounts in most major services cannot be legally sold or bought, and experts warn about the danger of such transactions for the sellers themselves. You will have problems if a profile that is directly linked to the data of a deceased relative — passport, photo and biometric data falls into the hands of fraudsters.

The key to the “money chest”

Banking products make it easier. After the death of a person, all settlement operations are stopped, and cards are blocked. But since they are tied to the account, funds from it are inherited by creditors in the order of priority or relatives according to the will. Alas, credit obligations can also be inherited.

Let’s say a widow has the PIN of her deceased husband’s credit card. Is it safe to go shopping? Lawyers do not recommend it.

Withdrawn money can become a reason for legal proceedings. The fact is that inherited property is distributed among all heirs and the court can force you to return the money spent from the card. The same applies to exchange-traded assets — money and securities stored digitally.

For those who make money

Online business accounts have become an important tool for entrepreneurship, social media accounts are essentially a “storefront” of a virtual store or a store’s website, where one can conduct business online from anywhere in the world. And how recognizable, popular among users account, depends on the success of a particular organization.

Recognizability is determined by the rules of social networks. With this in mind, the cost and price of the account itself in social networks increases, which can also be transferred from one user to another (by transferring login and password).

A special role is given to accounts in the project developed by Facebook — in the so-called meta-universe. In one of the next issues of our blog, we will elaborate on how “digital wealth” is transferred and inherited in entrepreneurship.

No laws exist, only a court

Let us repeat — so far the practice of digital inheritance is still poorly enshrined in the laws. Therefore, disputes about virtual assets are more often resolved in courts. Accounts in social networks are not treated as intellectual property, but rather as a means of communication. However, the content published in them can be referred to this category by a court decision, which means that the right to it can be included in the inheritance.

Rules of platforms

In the absence of clear legal requirements, digital platforms are developing their own rules. Some social networks already offer to appoint a digital heir. The terms of the transfer can be different.

Some services give the right to access all cloud data, except for content purchased from third parties. Others allow you to appoint a “custodian” who can only administer the account of a deceased person and transfer the page to a memorial status. The administrator will not have the ability to make changes to posts, read posts, put likes icons for the deceased, or delete friends.

Dead social networks

A logical option is to leave an order to delete your profile or block it after a certain time has elapsed since you stopped using it. But the heirs of the account may be asked for a death certificate in doing so.

Therefore, profiles most often turn into “dead souls” and become abandoned. So, experts estimate the total number of active accounts of deceased people in one of the largest social networks at 30 million, according to forecasts, by 2070 the number of such pages will exceed the number of profiles of living people, and by 2100 will reach 1.4 billion.

Do it yourself while you’re alive

While lawmakers are in no hurry to create a comprehensive digital law, you can take care of the fate of your digital accounts yourself while you’re still able to do so. The easiest thing to do is to make a list of all your logins and passwords and give them to a trusted person with instructions on what to do with your digital inheritance.

For those who are willing to be in control even after their demise, you may be advised to research the rules of each service you use and determine what preliminary steps will be required of you as the account owner. Some digital assets can be inherited automatically, such as e-wallets. Unlike gaming accounts, cloud profiles, or social media pages. If your digital inheritance is particularly valuable to you, draft and notarize a will.

Digital spiritualism

Progress is invading the afterlife. Practices have emerged to recreate or simulate the presence of deceased people using Artificial Intelligence technologies, such as “resurrection” which is based on digital data about the person — their photos, social media posts, and voice messages.

Clear debates exist about the ethics and legality of this. No unified opinion exists. Disputes are resolved based on judicial precedents and an expansive interpretation of current norms. Even though your “immortal” digital copy can be considered a result of intellectual activity, there must be an author, and neural networks do not fall under this definition yet.

Not surprisingly, stars and other celebrities are worried about the activities of their “posthumous clones”. The use of digital copies has even become one of the reasons for the recent Hollywood strikes. “I could get hit by a bus tomorrow, but my performances could go on and on, the audience wouldn’t even realize it wasn’t me,” Tom Hanks said in one of his podcasts.

The ethical question is also important. “The ‘resurrected’ personality is still available in the digital environment as a kind of cast of the past.

Neural networks recreate a copy of a person based on their past statements, images, and writings, but are unable to generate new information. Whether they can create an “immortal” piece of art is a significant question. So far, digital copies of a person are created, rather, for relatives and close friends, as a way to comfort and help cope with the loss.

See you on the other side.

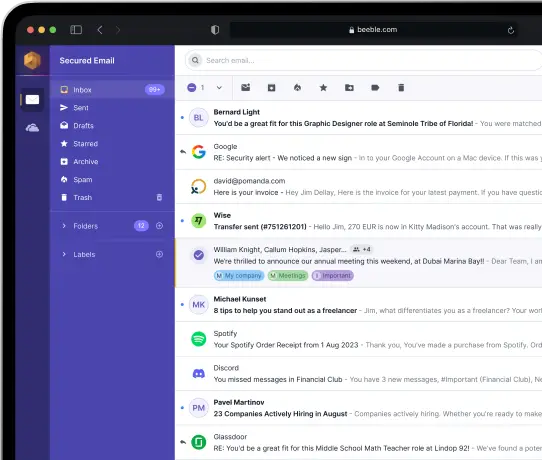

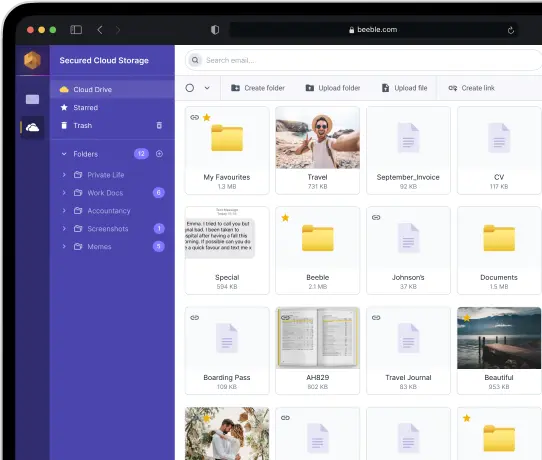

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account