Capital Rotation and Killer Upgrades: Why Analysts Call 2026 the 'Year of Ethereum'

The Great Rotation: Ethereum Eyes the Performance Crown in 2026

For years, Bitcoin (BTC) has operated as the undisputed king of the crypto jungle, its performance figures often dwarfing those of its peers. Since the market resurgence in 2023, for instance, Bitcoin posted an astonishing 457% return, while its closest competitor, Ethereum (ETH), delivered a comparatively muted 160% gain. This performance disparity has long fueled skepticism about Ethereum’s ability to generate alpha for investors.

However, market sentiment is shifting dramatically as we move through early 2026. A powerful confluence of capital rotation and robust on-chain development suggests that Ethereum is now poised to significantly narrow this performance gap—or perhaps even flip the script entirely—according to new analysis shared with Decrypt. On January 14, 2026, while Bitcoin pushed toward the $95,300 mark, Ethereum surged past $3,300, already exhibiting signs of this predicted divergence.

The Exodus from Bitcoin Dominance

The most compelling indicator of a looming shift is the changing landscape of market liquidity. The approval and subsequent stability of Bitcoin Spot Exchange-Traded Funds (ETFs) throughout 2025 initially solidified BTC’s dominance, yet the data now points to an expansion of investor focus beyond the flagship cryptocurrency. Bitcoin Dominance (BTC.D), which peaked around 66% in mid-2025, has been steadily trending lower, a classic signal of capital starting to diversify into the broader altcoin ecosystem, starting with Ethereum.

Quantitative analysts view this as a strategic rotation rather than a weakness in Bitcoin. Investors, having secured exposure to Bitcoin through regulated vehicles, are now seeking _higher beta_—a measure of volatility relative to the broader market—in the application layer. The key ratio that captures this shift, the ETH/BTC pair, has responded in kind, posting notable year-to-date gains in early 2026 and historically forewarning the start of a broader "altcoin season."

"A rising ETH/BTC ratio, coupled with stagnating Bitcoin dominance, has historically been associated with the start of an altcoin season,” noted one analyst to Decrypt, emphasizing that investors are actively seeking higher returns in the more complex, utility-driven Ethereum ecosystem.

The Institutional Bet: 2026 as the 'Year of Ethereum'

What makes this cycle feel distinctly different is the depth of institutional conviction now flowing into Ethereum. Global banking giant Standard Chartered has publicly called 2026 the ‘Year of Ethereum,’ suggesting its infrastructure maturation and next stage of adoption could see it outperform Bitcoin over the medium term. The bank projects a price target of $7,500 for ETH in 2026, building a long-term forecast that culminates in a staggering $40,000 target by 2030.

This institutional excitement is not purely speculative; it is structurally underpinned. Following the highly successful rollout of Bitcoin ETFs, regulated Ethereum-linked products are maturing quickly, with some reports noting relatively stronger institutional inflows into these ETH vehicles compared to their BTC counterparts in the first weeks of the year. Furthermore, the network’s role as the primary settlement layer for Tokenized Real-World Assets (RWAs) and decentralized finance (DeFi) positions it perfectly for the next epoch of traditional finance moving on-chain. Institutions are accumulating ETH for treasury management, further tightening the liquid supply and signaling high long-term confidence.

Utility Takes the Lead: An On-Chain Revolution

The technical foundation of Ethereum is arguably the most powerful catalyst for outperformance. Following years of meticulous development, the network is finally realizing its long-promised scalability potential, driving a massive resurgence in utility.

Recent protocol upgrades, like the Fusaka deployment in December 2025 and the subsequent BPO fork in January 2026, have been pivotal. The latter, for example, strategically raised the ‘blob limit’ for Layer-2 networks (L2s), which drastically reduces the cost of posting data back to the mainnet.

This direct improvement in L2 economics is translating immediately into real-world usage metrics:

- Record Wallets: The network has recently registered its highest-ever rate of new wallet creation, averaging over 327,000 new addresses daily, signaling a massive influx of fresh market participants.

- Transaction Surge: Total transaction count has grown, currently sitting around 2.05 million, a 31% spike since mid-December.

- Stablecoin Dominance: Stablecoin transfers, which represent genuine financial activity, now account for a staggering 35% to 40% of all network transactions, with Q4 2025 volumes hitting an all-time high.

These advancements show that Ethereum is transitioning from a scaling ambition to a high-utility, cost-effective global settlement layer. When market momentum (capital rotation) aligns so perfectly with fundamental technological utility, the resulting market movement can be explosive. The long-awaited flippening of investor narrative, if not market cap, may truly be upon us in 2026.

See you on the other side.

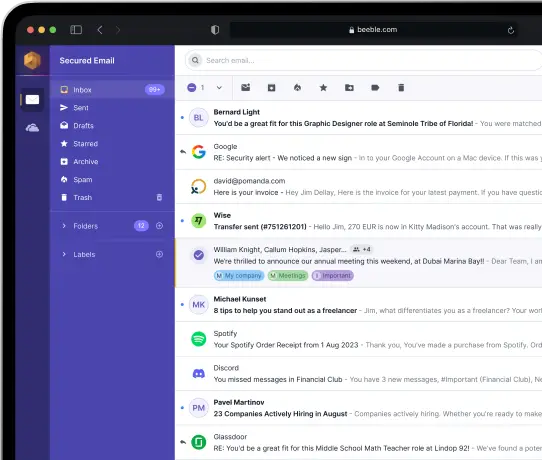

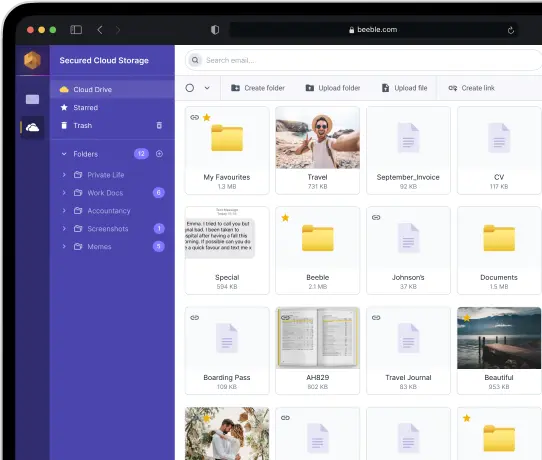

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account