Hong Kong Doubles Down on Crypto Regulation as Leaders Unveil New Digital Asset Framework

A New Chapter for Asia's Crypto Hub

Hong Kong is making bold moves to cement its position as a leading digital asset center. At the conclusion of Consensus Hong Kong in early 2026, government officials and financial regulators announced a comprehensive push to establish clearer rules for cryptocurrency businesses operating in the Special Administrative Region.

The timing is strategic. As other Asian financial centers like Singapore and Dubai compete for crypto talent and capital, Hong Kong is signaling that it wants to be more than just friendly to the industry—it wants to lead with substance. The latest announcements represent months of policy work aimed at balancing innovation with investor protection, a challenge that has tripped up regulators worldwide.

What Hong Kong Just Announced

The Consensus Hong Kong gathering served as the stage for several significant regulatory developments. While the Hong Kong Securities and Futures Commission (SFC) has been gradually building its crypto framework since introducing licensing requirements for virtual asset service providers in 2023, the newest initiatives aim to fill remaining gaps.

Key elements of the expanded regulatory regime include:

Enhanced licensing clarity for cryptocurrency exchanges and trading platforms. The SFC has reportedly streamlined application processes and reduced approval timelines, addressing complaints from firms that the previous system created unnecessary bottlenecks.

Retail investor access expansion. Hong Kong authorities indicated they would permit retail investors to access a broader range of digital assets, moving beyond the limited selection currently available. This marks a departure from the more conservative approach taken in recent years, though specific asset eligibility criteria remain under development.

Stablecoin regulations. Perhaps most significantly, officials outlined plans for a dedicated regulatory framework governing stablecoin issuers and service providers. This follows global trends, with jurisdictions from the European Union to Singapore implementing similar measures. The Hong Kong Monetary Authority (HKMA) is expected to publish detailed consultation papers in the coming months.

Tokenization initiatives. Government representatives discussed pilot programs for tokenizing real-world assets, including real estate and securities. These programs would operate under regulatory sandbox conditions, allowing experimentation while maintaining oversight.

Why This Matters Beyond Hong Kong

Hong Kong's regulatory evolution carries implications far beyond its own borders. As a major international financial center with deep connections to mainland China, the region's approach influences how global firms structure their Asian operations.

The relationship with mainland China remains complex. While China maintains strict prohibitions on cryptocurrency trading and mining, Hong Kong operates under the "one country, two systems" framework that grants it separate legal and financial systems. This creates unique dynamics where Hong Kong can pursue crypto-friendly policies while Beijing takes a harder line.

For international firms, a clear Hong Kong regulatory framework offers several advantages. The region provides common law protections, a mature banking system, and a talent pool experienced in traditional finance. Companies that obtain Hong Kong licenses can demonstrate regulatory credibility when expanding to other markets.

The Regulatory Balancing Act

Building a successful crypto regulatory regime requires threading a narrow needle. Too strict, and businesses relocate to friendlier jurisdictions. Too loose, and you risk becoming a haven for fraud and money laundering, which ultimately triggers crackdowns that damage legitimate players.

Hong Kong appears to be learning from both successes and failures elsewhere. The catastrophic collapse of FTX in late 2022 demonstrated what happens when major platforms operate without sufficient oversight. Conversely, overly restrictive approaches have pushed innovation underground or offshore.

The SFC has emphasized that its goal is not to simply replicate regulations designed for traditional securities. Christopher Hui, Secretary for Financial Services and the Treasury, has previously stated that Hong Kong aims to create bespoke frameworks that account for the unique characteristics of digital assets while maintaining high standards for consumer protection.

Practical Implications for Businesses and Investors

For cryptocurrency companies considering Hong Kong, the enhanced regulatory clarity creates both opportunities and obligations.

Licensing requirements remain substantial. Firms must demonstrate adequate financial resources, implement robust anti-money laundering controls, segregate client assets, and employ qualified personnel. The application process involves detailed documentation and can take several months.

Compliance costs should not be underestimated. Smaller startups may find the regulatory burden challenging, while established platforms with existing compliance infrastructure can adapt more easily. This naturally creates some market consolidation, favoring larger, better-resourced players.

For retail investors, expanded access to digital assets comes with important caveats. The SFC has indicated it will maintain suitability assessments and risk warnings. Investors should understand that regulatory approval of a platform does not eliminate investment risk—cryptocurrencies remain volatile, and losses are possible even on licensed exchanges.

What Comes Next

The initiatives announced at Consensus Hong Kong represent policy direction rather than final rules. Several steps remain before the enhanced framework becomes operational:

Public consultations will allow industry stakeholders to provide feedback on proposed regulations. These typically run for several weeks and can result in significant modifications to initial proposals.

Legislative processes may be required for certain elements, particularly the stablecoin framework. This involves review by Hong Kong's Legislative Council and can extend implementation timelines.

International coordination continues to play a role. Hong Kong regulators participate in global standard-setting bodies like the Financial Stability Board and regularly consult with counterparts in other jurisdictions. Expect the final framework to reflect international best practices while accommodating local conditions.

The Road Ahead

Hong Kong's regulatory push reflects a broader maturation of the cryptocurrency industry. The days of operating in legal gray zones are ending as governments worldwide implement comprehensive frameworks.

For Hong Kong specifically, success will be measured not just by how many licenses it issues, but by whether it can foster genuine innovation while maintaining market integrity. The region has natural advantages—established financial infrastructure, rule of law, and geographic position—but execution matters.

The announcements at Consensus Hong Kong signal clear intent. Now comes the harder work of turning policy statements into functioning regulations that serve businesses, protect consumers, and support the growth of a legitimate digital asset ecosystem.

Investors and companies alike should monitor the consultation processes closely. The details matter, and active participation in shaping these rules will help ensure they strike the right balance between enabling innovation and managing risk.

Sources

- Hong Kong Securities and Futures Commission (SFC) official website and regulatory announcements

- Hong Kong Monetary Authority (HKMA) policy statements on virtual assets

- Consensus Hong Kong 2026 conference proceedings and announcements

- Hong Kong Government Financial Services and the Treasury Bureau press releases

- CoinDesk coverage of Hong Kong regulatory developments

- Asia Securities Industry & Financial Markets Association (ASIFMA) reports on Hong Kong crypto regulation

See you on the other side.

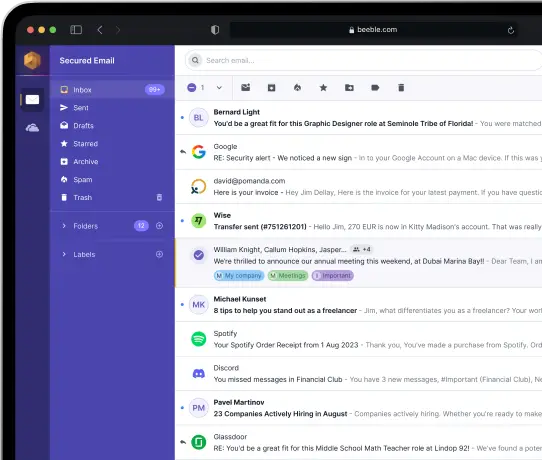

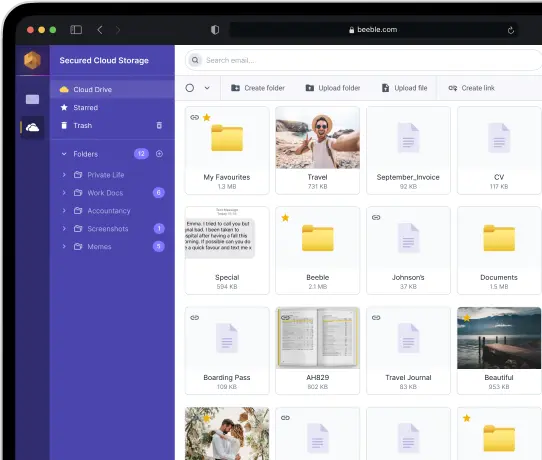

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account