India’s $200 Billion AI Gambit: Building the Backbone of Global Computing

The global landscape of artificial intelligence is shifting from a race for better algorithms to a desperate scramble for the physical infrastructure that powers them. As of early 2026, the bottleneck for AI progress isn't just code; it is silicon, electricity, and real estate. Recognizing this shift, India has launched an ambitious initiative to attract over $200 billion in AI infrastructure investment by 2028.

This move marks a fundamental transition in India’s economic strategy. For decades, the nation was the world’s back office, providing software services and support. Now, the Indian government and its largest private conglomerates are betting that the country can become the world’s powerhouse for high-performance computing (HPC) and sovereign AI development.

The IndiaAI Mission and the Push for Sovereign Compute

At the heart of this $200 billion target is the expanded IndiaAI Mission. Originally conceptualized with a $1.25 billion budget, the mission has evolved into a massive public-private partnership framework. The goal is to build a domestic ecosystem that reduces reliance on foreign cloud providers while ensuring that Indian data remains on Indian soil.

Sovereign AI is the driving philosophy here. In a world where data is a strategic asset, the Indian government views local compute capacity as a matter of national security. By incentivizing the construction of massive data centers and the procurement of tens of thousands of high-end GPUs—primarily through partnerships with companies like NVIDIA—India aims to provide affordable compute access to its burgeoning startup ecosystem.

The Private Sector Engine: Reliance, Tata, and Adani

While the government sets the policy, the heavy lifting is being done by India’s industrial giants. Reliance Industries and the Tata Group have both inked significant deals to deploy NVIDIA’s Blackwell architecture at scale. These aren't just small-scale pilots; they are foundational deployments intended to power everything from local language models (LLMs) to advanced weather forecasting and drug discovery.

Reliance, in particular, is leveraging its massive telecommunications footprint to integrate AI into its 5G network, aiming to offer "AI as a service" to millions of small businesses. Meanwhile, the Adani Group is focusing on the intersection of green energy and data centers. Since AI workloads are notoriously power-hungry, Adani’s ability to provide renewable energy to its data parks is a critical competitive advantage in meeting ESG (Environmental, Social, and Governance) goals.

Technical Challenges: Power, Cooling, and Connectivity

Building $200$ billion worth of infrastructure is not as simple as buying chips and plugging them in. The technical hurdles are significant. High-density AI racks require specialized cooling systems—often liquid cooling—that are far more complex than traditional air-cooled server rooms.

Furthermore, the power grid must be modernized to handle the localized surges in demand that a massive AI cluster requires. India is currently investing in “Smart Grid” technologies to ensure that these data centers do not compromise the stability of the public electricity supply. There is also the matter of latency; for AI to be useful in real-time applications like autonomous logistics or remote surgery, the infrastructure must be geographically distributed across the subcontinent.

Global Context: How India Compares

To understand the scale of India's ambition, it is helpful to look at how it stacks up against other global players in terms of AI infrastructure goals for 2026–2028.

| Region | Estimated AI Infrastructure Target | Primary Focus | Key Advantage |

|---|---|---|---|

| India | $200B+ | Sovereign AI & Public Compute | Massive Data Scale & Low Labor Cost |

| United States | $500B+ | Frontier Model Training | Leading Chip Design & VC Ecosystem |

| China | $300B+ | National Computing Power Network | Vertical Integration & State Control |

| European Union | $150B+ | Ethical AI & Privacy-First Compute | Strong Regulatory Framework |

Overcoming the Talent Gap

Infrastructure is useless without the human capital to manage it. A significant portion of the projected $200 billion investment is expected to flow into specialized training programs. India currently produces more engineering graduates than almost any other country, but the specific skills required for AI infrastructure—such as low-level GPU programming, distributed systems management, and AI-optimized networking—are in short supply.

To bridge this gap, the government has partnered with academic institutions to create "AI Centers of Excellence." These centers act as bridges between theoretical research and industrial application, ensuring that the technicians and engineers of tomorrow are ready to operate the hardware being installed today.

Practical Takeaways for Businesses and Investors

For organizations looking to navigate this massive influx of capital and infrastructure, the following steps are recommended:

- Prioritize Localization: If you are operating in the Indian market, start migrating workloads to local data centers to take advantage of government subsidies and lower latency.

- Invest in Multi-Cloud Strategies: Don't get locked into a single provider. With the rise of domestic Indian cloud players, maintaining flexibility will allow you to optimize for cost as new capacity comes online.

- Focus on Vertical AI: The next few years will see a surplus of compute. The real value will be in applying that compute to specific Indian problems—such as agriculture, vernacular language processing, and fintech.

- Monitor Regulatory Changes: As India builds its own infrastructure, expect stricter data localization laws. Ensure your data architecture is compliant with the Digital Personal Data Protection (DPDP) Act.

The Road Ahead

India’s bid for $200 billion in AI investment is more than just a financial target; it is a statement of intent. By building the physical foundations of the AI era, India is attempting to leapfrog its traditional role in the global tech hierarchy. If successful, the country will not just be a consumer of AI, but the very engine that drives it for the next decade. The path is fraught with logistical and technical challenges, but the momentum—driven by both state policy and private capital—suggests that India is well on its way to becoming an indispensable node in the global AI network.

See you on the other side.

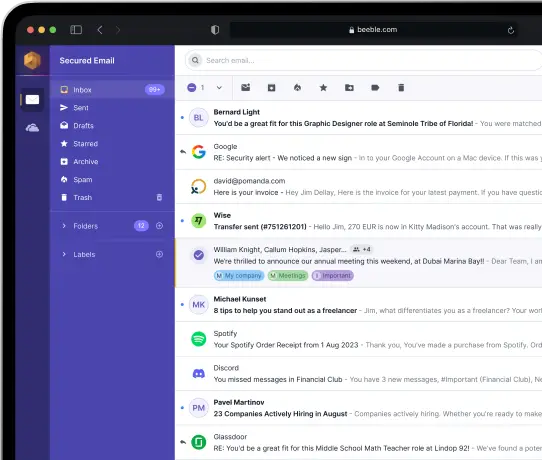

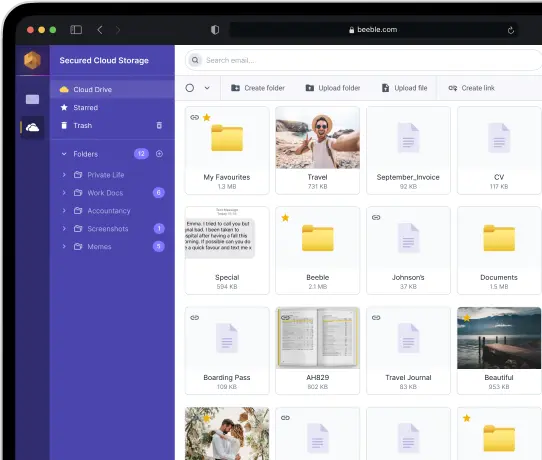

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account