The $20 Million Slot Machine: FBI Warns of Surge in ATM Jackpotting Attacks

In the world of high-stakes cybercrime, some of the most effective attacks aren't launched from a bedroom halfway across the world, but from a sidewalk in broad daylight. The FBI has issued a stark security bulletin detailing a massive resurgence in "ATM jackpotting," a sophisticated physical and digital heist that turns standard cash dispensers into high-speed money fountains.

According to the latest federal data, 2025 was a record-breaking year for these crimes. Hackers successfully executed more than 700 attacks across the United States, netting an estimated $20 million in stolen cash. This represents a significant escalation in both the frequency and the technical precision of these heists, prompting a nationwide alert for financial institutions and independent ATM operators.

What is ATM Jackpotting?

To understand jackpotting, it helps to think of an ATM not as a safe, but as a specialized computer sitting on top of a cash vault. Under normal circumstances, the computer (the "top hat") only tells the vault to release money after a legitimate card is swiped and a PIN is verified.

In a jackpotting attack, criminals bypass the card reader and the bank’s authorization network entirely. They gain physical access to the ATM’s internal hardware—often by using a counterfeit key or drilling a small hole to access a specific port—and connect a secondary device, often referred to as a "black box." This device sends a direct command to the cash-dispensing peripheral, forcing it to empty its cassettes at a rate of several bills per second. To a passerby, it looks like the machine has simply malfunctioned or hit a literal jackpot.

The Anatomy of a Modern Heist

The 2025 surge highlights a shift toward more streamlined operations. While early versions of this attack required bulky laptops and complex wiring, the FBI notes that modern attackers are using miniaturized, custom-built circuit boards that can be hidden behind the ATM's plastic fascia in seconds.

Once the device is attached, the "mule" (the person physically standing at the machine) often communicates with a remote handler via an encrypted messaging app. The handler sends a signal to the black box to begin the payout. This separation of roles makes it harder for law enforcement to track the masterminds behind the operation, as the person caught on camera is often a low-level recruit.

Why 2025 Became the Year of the Jackpot

Security experts point to a "perfect storm" of factors that contributed to the $20 million loss last year. Many ATMs, particularly those located in convenience stores or standalone kiosks, still run on outdated versions of Windows. These legacy systems often lack the robust encryption required to protect the communication line between the ATM's PC and the cash dispenser.

Furthermore, the hardware itself has become a bottleneck. While banks have spent years upgrading chip-and-pin (EMV) technology to prevent card skimming, they have been slower to implement physical security upgrades that prevent access to the internal USB or serial ports. For a criminal, it is often easier to trick the machine into giving up its own money than it is to steal the data of individual customers.

The Impact on Financial Institutions

The $20 million figure cited by the FBI only accounts for the cash actually stolen. For banks and independent operators, the true cost is much higher. A single jackpotting incident often results in:

- Hardware Damage: Attackers frequently use drills or crowbars to access internal ports, rendering the machine unusable.

- Software Remediation: Once an ATM is compromised, it must be taken offline for a full forensic audit and software reinstallation.

- Insurance Premiums: As the frequency of these attacks rises, the cost of insuring cash-in-transit and ATM hardware has spiked.

How the Industry is Fighting Back

In response to the FBI’s bulletin, the financial sector is moving toward a more "zero-trust" architecture for hardware. This includes the implementation of end-to-end encryption between the ATM's core processor and the dispenser. If the dispenser doesn't receive a cryptographically signed command from the authorized bank software, it simply won't release the cash, even if a black box is attached.

Physical defenses are also being bolstered. New "anti-drilling" plates and upgraded internal locks are being installed to make it harder for attackers to reach the internal ports. Some operators are even deploying GPS-linked alarms that notify local police the moment the ATM's outer casing is breached.

Practical Takeaways for Operators and Consumers

While jackpotting primarily targets the owners of the machines rather than individual bank accounts, these attacks can lead to service disruptions and increased fees as banks recoup their losses.

For ATM Operators:

- Update Firmware: Ensure that all dispensers are running the latest firmware with encrypted communication enabled.

- Physical Audits: Regularly inspect the top hat of the ATM for signs of tampering, such as misaligned panels or new, unexplained holes.

- Limit Access: Replace standard manufacturer keys with unique, high-security locks.

For Consumers:

- Stay Alert: If you see someone spending an unusually long time at an ATM without a card in hand, or if the machine appears to be partially disassembled, avoid the area and contact the authorities.

- Prefer Internal Machines: ATMs located inside bank lobbies or high-traffic, well-lit areas are significantly less likely to be targeted by jackpotting crews than standalone kiosks in dark corners.

As we move further into 2026, the battle for the sidewalk's most valuable real estate continues. The FBI's warning serves as a reminder that in the digital age, sometimes the most dangerous threat is the one standing right in front of the machine.

Sources

- Federal Bureau of Investigation (FBI) Cyber Division Bulletins

- ATM Industry Association (ATMIA) Global Fraud Reports

- Krebs on Security: Analysis of Black Box Attacks

- Department of Justice: Recent Prosecutions in ATM Malware Cases

See you on the other side.

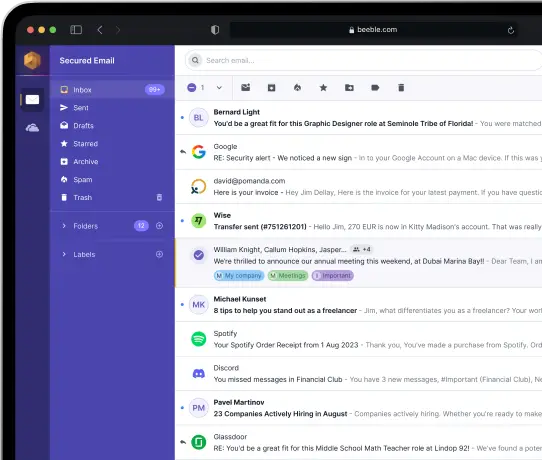

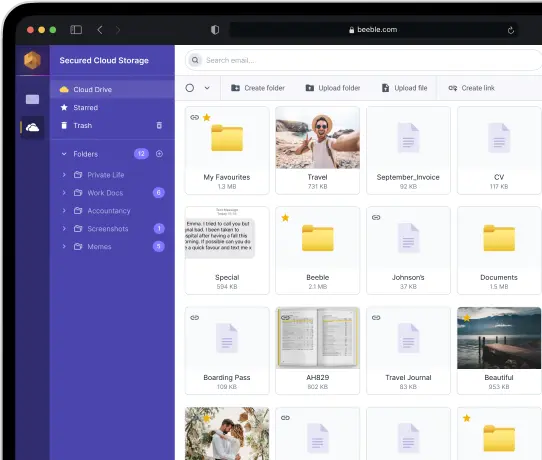

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account