The Dutch Crackdown: Why the Netherlands Just Issued an €840,000 Ultimatum to Polymarket

The tension between decentralized finance and national sovereignty reached a boiling point this week as the Netherlands became the latest European nation to draw a hard line against Polymarket. The Dutch Kansspelautoriteit (KSA), the country’s gambling regulator, has officially ordered the world’s largest decentralized prediction market to cease operations within its borders. The penalty for non-compliance is steep: a cumulative fine that could reach €840,000.

This move marks a significant escalation in the European Union’s broader effort to categorize crypto-based forecasting tools. While Polymarket advocates argue that these platforms are essential pieces of modern financial infrastructure, regulators increasingly view them through the lens of unlicensed gambling. For the tech industry, the Dutch decision isn't just a local legal hurdle; it is a signal of how the regulatory landscape for Web3 is hardening across the continent.

The KSA’s Legal Argument

At the heart of the Dutch regulator's decision is the definition of a "game of chance." Under the Netherlands’ Betting and Gaming Act, any entity offering services where prizes can be won—and where the outcome is determined by chance rather than skill—must hold a specific license. The KSA contends that because Polymarket allows users to bet on the outcome of future events, from elections to sporting matches, it functions as a gambling house.

The regulator’s investigation reportedly found that Dutch citizens were able to easily access the platform, deposit funds via crypto wallets, and place wagers without the consumer protections required by Dutch law. The KSA’s primary concern is the lack of mandatory age verification and the absence of "responsible gaming" tools, such as self-exclusion registries, which are mandatory for licensed operators in the Netherlands.

Financial Infrastructure or Digital Casino?

Polymarket’s founder, Shayne Coplan, has long maintained that prediction markets are a different breed of technology. Unlike traditional sportsbooks, prediction markets aggregate global information to provide real-time data on the probability of future events. Coplan has frequently described the platform as "financial infrastructure"—a tool for hedging risk and discovering truth in an era of misinformation.

To the KSA, however, the underlying technology—whether it is a blockchain or a centralized database—is irrelevant. Their focus remains on the activity itself. If a user puts money at risk based on an uncertain outcome, the Dutch authorities classify it as gambling. This fundamental disagreement highlights the growing gap between the "code is law" philosophy of the crypto world and the "activity-based regulation" favored by European governments.

A Growing Pattern of European Resistance

The Netherlands is not acting in a vacuum. This ban follows similar scrutiny from France’s National Gaming Authority (ANJ), which recently moved to block access to the site. Across the Atlantic, Polymarket has already faced its share of friction with the U.S. Commodity Futures Trading Commission (CFTC), leading the platform to geoblock U.S. IP addresses.

What makes the Dutch situation unique is the specific threat of a massive financial penalty. By setting the fine at €840,000, the KSA is attempting to make the cost of doing business in the Netherlands prohibitively expensive, even for a platform that has seen billions of dollars in volume. It is a strategy designed to force a total withdrawal rather than a slow legal negotiation.

The Enforcement Dilemma

Enforcing a ban on a decentralized protocol presents a unique set of technical challenges. Polymarket operates on the Polygon blockchain, and while the primary web interface (Polymarket.com) can be geoblocked, the underlying smart contracts remain accessible to anyone with an internet connection and a VPN.

Regulators are aware of this loophole. The KSA’s order likely targets the company’s front-end interface, marketing efforts, and any localized support. While they may not be able to "turn off" the blockchain, they can effectively cut off the average user by making the platform difficult to access without specialized technical knowledge. For a platform aiming for mainstream adoption, being relegated to the "dark corners" of the web via VPNs is a significant blow to its growth and liquidity.

Practical Takeaways for Users and Investors

If you are a user of prediction markets or an investor in the space, the Dutch ban serves as a vital case study in regulatory risk. Here is what you should consider moving forward:

- Geographic Sensitivity: If you are located in the EU, expect more platforms to implement stricter geofencing. Ensure your assets are not locked in a platform that might suddenly restrict access to your region.

- The Shift to KYC: To survive in Europe, decentralized platforms may eventually be forced to implement Know Your Customer (KYC) protocols. The era of anonymous, high-stakes prediction markets is likely coming to an end in regulated markets.

- Regulatory Arbitrage is Fading: The idea that a platform can avoid local laws simply by being "decentralized" is losing its efficacy. Regulators are now targeting the developers and the web interfaces that provide access to these protocols.

The Road Ahead

The outcome of this standoff will likely set a precedent for how other EU member states handle decentralized applications (dApps). If Polymarket complies and exits the Dutch market, it may embolden other regulators to issue similar ultimatums. If it fights the fine in court, we may see a landmark ruling that finally defines where "information markets" end and "gambling" begins.

For now, the message from the Netherlands is clear: innovation does not grant an exemption from local consumer protection laws. As the €840,000 deadline approaches, the tech world will be watching to see if Polymarket chooses to pivot its business model or retreat from one of Europe’s most tech-savvy markets.

Sources

- Kansspelautoriteit (KSA) Official Enforcement Notices

- Dutch Betting and Gaming Act (Wet op de kansspelen)

- Polymarket Corporate Communications and Public Statements

- European Gaming and Betting Association (EGBA) Regulatory Updates

See you on the other side.

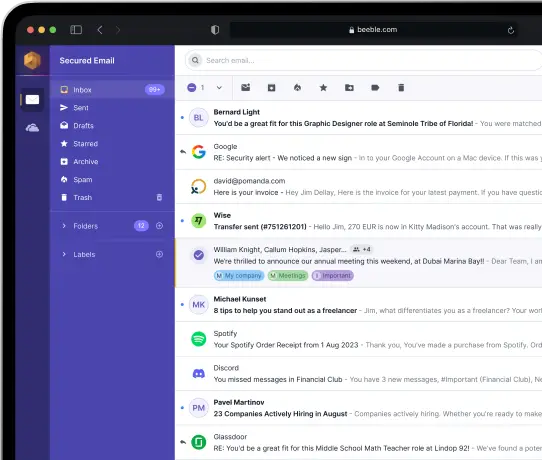

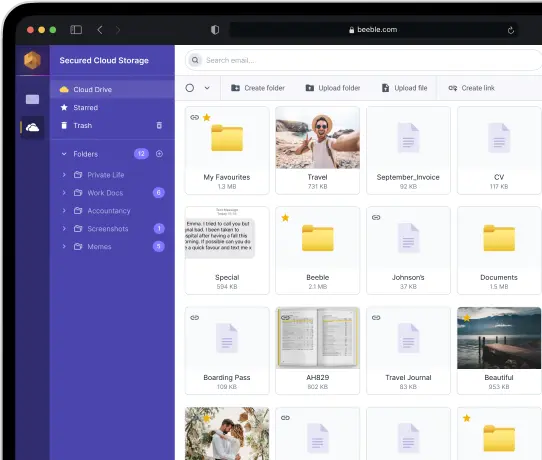

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account