Binance's CZ Says Privacy Is Crypto's Missing Link to Mainstream Adoption

The Privacy Problem Holding Crypto Back

Changpeng Zhao, founder of Binance and one of cryptocurrency's most influential voices, has identified what he believes is a critical barrier preventing digital assets from achieving widespread acceptance: inadequate privacy protections. Speaking recently about the industry's future direction, CZ argued that without robust privacy features, cryptocurrencies will struggle to move beyond niche adoption into everyday financial life.

The statement carries weight given Zhao's position at the helm of the world's largest cryptocurrency exchange by trading volume. His perspective reflects growing recognition within the industry that transparency—while valuable for security and trust—can become a liability when every transaction is permanently visible on a public ledger.

Why Privacy Matters More Than You Think

Most people assume cryptocurrency transactions are anonymous. The reality is quite different. Bitcoin, Ethereum, and many other popular blockchains are pseudonymous rather than anonymous. Every transaction is recorded on a public ledger that anyone can inspect. While addresses aren't directly linked to real-world identities, determined analysts can often connect the dots through various techniques.

Imagine if your bank statement was publicly available for anyone to examine—not just the bank, but your neighbors, employers, and competitors. They could see your salary deposits, rent payments, shopping habits, and charitable donations. That's essentially how most cryptocurrency transactions work today.

This transparency creates several problems. Businesses may hesitate to use crypto if competitors can analyze their payment flows and reverse-engineer supply chains. Individuals face surveillance risks, with their financial histories potentially exposed. Even simple purchases become uncomfortable when the recipient can see your entire transaction history and wallet balance.

The Current State of Crypto Privacy

The cryptocurrency ecosystem does include privacy-focused solutions, though they remain fragmented and underutilized. Monero and Zcash have built privacy directly into their protocols using techniques like ring signatures and zero-knowledge proofs. These technologies obscure transaction details while still maintaining blockchain integrity.

However, privacy coins face significant headwinds. Regulatory scrutiny has intensified, with some exchanges delisting privacy-focused cryptocurrencies over concerns about illicit use. Law enforcement agencies worry these tools could facilitate money laundering or terrorist financing. This tension between financial privacy as a civil liberty and privacy as a potential shield for criminal activity remains unresolved.

Meanwhile, Bitcoin users can employ mixing services or CoinJoin implementations to enhance privacy, but these require technical knowledge and add friction to the user experience. The average person opening their first crypto wallet has no privacy protections by default.

What CZ's Call to Action Means

Zhao's emphasis on privacy suggests the industry needs to make these protections accessible and standard rather than optional and complex. This could take several forms:

Layer-two privacy solutions could add confidential transaction capabilities to existing blockchains without requiring fundamental protocol changes. Ethereum's ecosystem has seen experimentation with tornado-style privacy pools and zero-knowledge rollups that obscure transaction details.

Selective disclosure mechanisms might allow users to prove certain facts about their transactions without revealing everything. For instance, demonstrating you paid taxes on crypto gains without exposing your entire portfolio, or proving you have sufficient funds without showing your exact balance.

Privacy by default with compliance options could flip the current model. Instead of transactions being public unless you take special steps to hide them, they could be private unless you choose to disclose them—for tax reporting, audits, or regulatory compliance.

The Regulatory Tightrope

Any push toward greater privacy must navigate an increasingly complex regulatory landscape. The Financial Action Task Force has pressed jurisdictions worldwide to apply anti-money laundering rules to cryptocurrency service providers. The European Union's Markets in Crypto-Assets regulation and various national frameworks impose transparency requirements that can conflict with strong privacy protections.

The challenge is designing systems that prevent financial crimes without creating mass surveillance infrastructure. Traditional banking offers a middle ground: transactions are private from the general public but visible to the financial institution and, with proper legal process, to authorities. Replicating this balance in a decentralized system requires cryptographic sophistication.

Some projects are exploring regulatory-compliant privacy through techniques like selective transparency, where transaction details are encrypted but can be decrypted by the user or, with permission, by auditors or investigators. These approaches attempt to satisfy both privacy advocates and compliance requirements, though they're still maturing.

Practical Implications for Users and Developers

For everyday cryptocurrency users, CZ's comments signal that privacy features may become more prominent in mainstream wallets and applications. This could mean simpler access to privacy-preserving transactions without needing to understand the underlying mathematics.

Developers face an invitation to prioritize privacy-enhancing technologies. This might include integrating zero-knowledge proofs, building better mixing protocols, or creating user-friendly privacy tools that don't require technical expertise. The industry needs privacy solutions that work as seamlessly as sending a regular transaction.

Businesses evaluating cryptocurrency adoption should consider how blockchain transparency affects their competitive position. Companies handling sensitive transactions may need to wait for better privacy infrastructure or explore private blockchain alternatives that limit who can view transaction data.

The Road Ahead

Whether privacy enhancements will actually drive mainstream adoption remains to be seen. Cryptocurrency faces numerous adoption barriers beyond privacy: volatility, complexity, scaling limitations, and regulatory uncertainty all play roles. However, Zhao's focus on this issue suggests industry leaders recognize that financial privacy isn't just a niche concern—it's fundamental to how people expect their money to work.

The coming years will likely see continued tension between privacy innovation and regulatory oversight. The industry that emerges will need to balance individual financial privacy rights, business confidentiality needs, and legitimate law enforcement requirements. Getting that balance right could determine whether cryptocurrency fulfills its promise as a mainstream financial technology or remains a specialized tool for specific use cases.

For now, CZ's call serves as a reminder that technical capability isn't enough. To truly compete with traditional finance, cryptocurrency must offer not just new features but familiar protections—including the privacy that users of conventional banking systems take for granted.

Sources

- Binance official announcements and statements

- Financial Action Task Force guidance on virtual assets

- European Union Markets in Crypto-Assets (MiCA) regulation documentation

- Monero and Zcash technical documentation

- Blockchain analysis and privacy research papers

- Cryptocurrency regulatory compliance frameworks

See you on the other side.

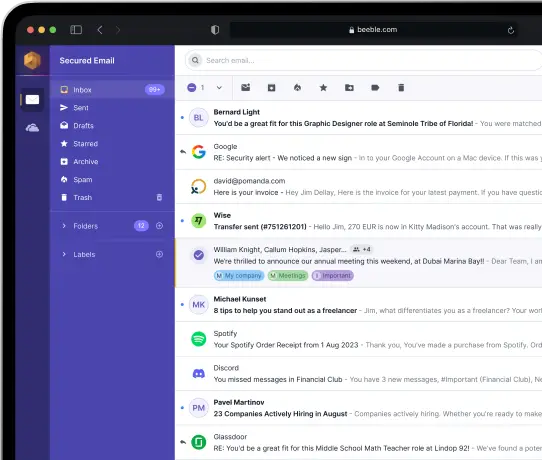

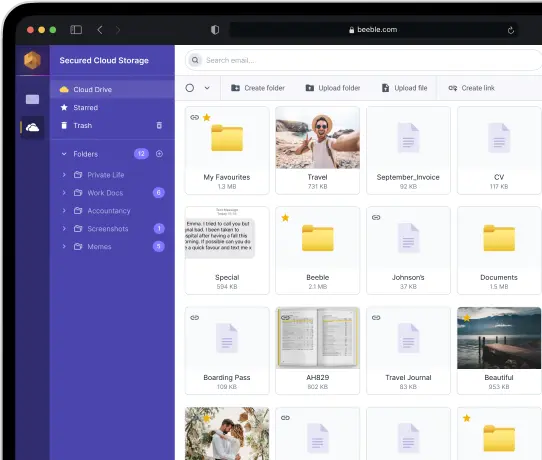

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account