The Digital Euro’s Political Litmus Test: European Parliament Votes on Support for ECB’s Digital Cash

The road to a sovereign European digital currency is winding through the political arena today. The European Parliament is set to vote on a key amendment that expresses support for the European Central Bank’s (ECB) digital euro project. While the vote is part of an annual report on the ECB's work and holds no direct legislative power, its outcome will serve as a crucial public gauge of political backing—or resistance—among EU lawmakers for what the ECB envisions as the digital form of cash.

Forty-eight Members of the European Parliament (MEPs) pushed to include the supportive passage. The result of this non-binding measure will provide an essential political barometer, signaling the mood in Brussels as the bloc moves toward a decisive legislative period that will determine the project's future.

The Parliament’s Political Litmus Test

Today's procedural vote on the ECB’s annual report is merely an early signal, but it holds considerable weight in the broader political narrative. The ECB’s push for a Central Bank Digital Currency (CBDC) has met with varied enthusiasm across the political spectrum, with proponents championing strategic autonomy and critics raising alarms about state surveillance and market disruption.

Support for the digital euro is often concentrated among liberal and center-left groups, who echo the ECB's position that the currency is vital for preserving monetary sovereignty and reducing the bloc’s reliance on non-European payment processors, such as Visa and Mastercard. Conversely, vocal opposition, particularly from right-leaning factions, has questioned the value proposition for the average citizen, suggesting the digital euro is an unnecessary "political prestige project" that competes with existing private-sector solutions.

The real legislative battle is set for the first half of 2026, when the Parliament is expected to vote on the formal regulation governing the digital euro. Today's result will provide the ECB with a clear indication of how much work remains to secure the necessary majority for that critical upcoming decision.

Defining the Digital Euro: An Electronic Form of Cash

The digital euro is conceptualized as an electronic counterpart to physical banknotes and coins. It would be issued directly by the ECB, carrying central bank liability, which ensures its guaranteed value and security. It is explicitly designed to complement existing forms of payment, not replace them.

Key features that differentiate the digital euro from private commercial bank money and cryptocurrencies include:

- Universal Acceptance: It would be accepted and accessible across the entire euro area, offering a pan-European solution that is currently lacking.

- Free of Charge: Basic usage, such as making payments, would be free for everyone in the euro area.

- Offline Capability: Users would be able to make payments without an internet connection, a feature that enhances resilience and inclusion.

- Security and Stability: Unlike volatile crypto-assets, the digital euro would be backed by the ECB, making it a stable, risk-free public currency.

The Privacy Paradox: Cash-like Anonymity vs. AML

One of the most contentious topics surrounding the digital euro is privacy. The ECB has stressed a "privacy-by-design" approach, promising an unprecedented level of data protection compared to existing digital payment services.

Crucially, the digital euro is designed to offer a cash-like level of privacy for offline payments. In these proximity transactions, personal details would be known only to the payer and the payee, with no data shared with the Eurosystem or other service providers.

However, this cash-like anonymity is not absolute for all transactions:

- Online Payments: While the Eurosystem would use pseudonymization and encryption to prevent the direct linking of transactions to specific users, the distribution is still channeled through intermediaries (Payment Service Providers/PSPs). These PSPs would carry out necessary Anti-Money Laundering (AML) and Counter-Terrorist Financing (CFT) checks during the funding and defunding process, a standard requirement for all non-anonymous digital transactions.

The Strategic Rationale: Sovereignty and Autonomy

Beyond consumer convenience, the primary driver for the digital euro is geopolitical and strategic. Currently, a significant majority—nearly 70%—of card-initiated transactions in Europe are processed by non-European companies, creating a potential strategic vulnerability.

By establishing its own digital payment rail, the EU aims to:

- Reduce External Reliance: Mitigate the risk of third countries imposing payment restrictions or surveillance on European transactions.

- Foster Competition: Introduce a robust, pan-European competitor to the dominant global card schemes.

- Ensure Inclusion: Guarantee that all citizens and businesses have access to risk-free central bank money, even as cash usage declines.

Practical Takeaways: What Happens Next

The immediate future hinges on political alignment, with the ECB's technical work advancing rapidly in parallel. The central bank completed its preparation phase in October 2025 and is now in the next phase of technical capacity building.

If the European Parliament and Council adopt the necessary legislation in the course of 2026, the project timeline will accelerate:

| Stage | Estimated Timing (Subject to 2026 Legislation) | Key Action |

|---|---|---|

| Pilot Phase | Mid-2027 | Testing of technical capacity, user experience, and core functionalities. |

| Readiness for Issuance | During 2029 | The Eurosystem aims to be technically ready for a possible first issuance. |

| Final Decision | Post-2026 Legislation | The ECB Governing Council will only make the final decision on issuance after the EU regulation is fully adopted. |

For citizens, the key takeaway from the ECB’s current design is the promise of a universally accepted, free, and privacy-focused digital option that functions even without connectivity. For lawmakers, the result of today’s vote—even if symbolic—will signal the momentum behind the project, setting the stage for the crucial legislative debates later this year that could cement the 2029 issuance timeline.

See you on the other side.

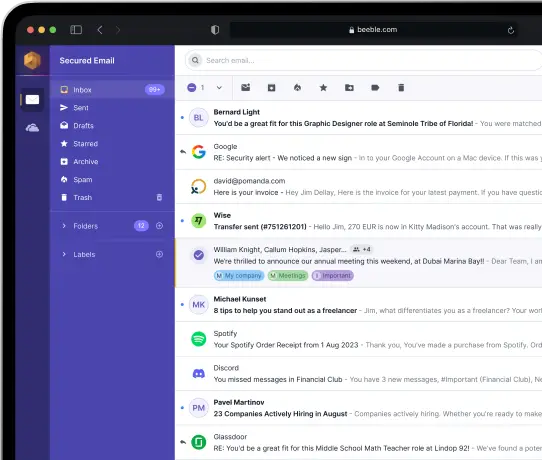

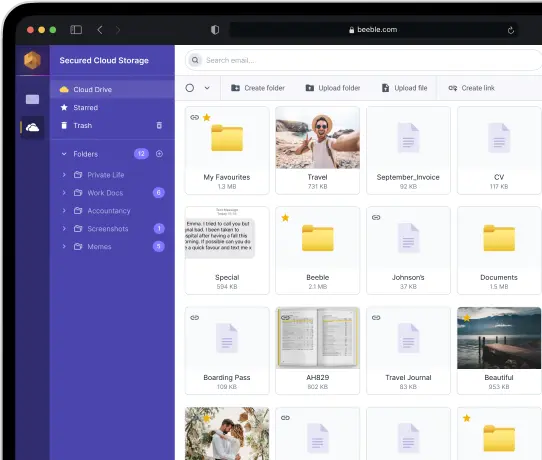

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account