Do You Owe Taxes on Paper Crypto Profits in the Netherlands?

The Big Change Coming in 2028

Cryptocurrency investors in the Netherlands face a significant shift in how their digital assets will be taxed. Starting January 2028, the Dutch tax authority will tax actual returns—including unrealized gains on crypto holdings—marking a departure from the current system that taxes fictitious returns based on a presumed percentage yield.

This reform affects anyone holding cryptocurrency in the Netherlands, whether you're a casual Bitcoin holder or an active DeFi participant. Understanding what's changing and how it impacts your tax situation is essential, especially as the implementation date approaches.

How Crypto Taxation Works Today

Under the current Box 3 wealth tax system in the Netherlands, crypto assets are treated as savings and investments. Rather than taxing actual profits or losses, the Dutch tax authority (Belastingdienst) applies a deemed return—a fictional percentage yield calculated based on the total value of your assets.

For 2026, the system uses tiered brackets with different deemed returns. Your cryptocurrency holdings fall into the "other assets" category, which typically assumes higher returns than savings accounts. You pay tax on this presumed income, regardless of whether you actually made a profit, broke even, or lost money.

This approach has faced serious legal challenges. The Dutch Supreme Court ruled in December 2021 that taxing fictional returns instead of actual returns violated property rights under the European Convention on Human Rights. The government was ordered to develop a fairer system—hence the 2028 reform.

What Changes in 2028: Taxing Real Returns

The new system pivots to taxing actual annual returns, which includes both realized and unrealized gains. Here's what that means for crypto investors:

If you bought Ethereum at €2,000 and it's now worth €3,000, that €1,000 increase counts as an unrealized gain. Under the 2028 rules, you'll owe tax on that paper profit—even if you haven't sold.

The tax rate will remain around 32-36% on the taxable amount, consistent with Box 3 taxation. However, you'll receive a €1,800 annual exemption (approximately $2,000) on your total returns across all assets, not just crypto.

One crucial detail: losses can be carried forward to offset future gains, but they won't generate tax refunds. If your portfolio drops €5,000 in 2028, you can use that loss to reduce taxable gains in subsequent years, but you won't receive money back from the tax authority.

Calculating Your Crypto Tax Liability

Let's walk through a practical example to illustrate how this works.

Imagine you hold €50,000 in cryptocurrency on January 1, 2028. By December 31, 2028, your portfolio has grown to €60,000—a €10,000 unrealized gain. You also have €20,000 in a savings account earning €400 in interest.

Your total return for 2028 is €10,400. After subtracting the €1,800 exemption, your taxable return is €8,600. At an approximate 32% tax rate, you'd owe roughly €2,752 in Box 3 tax.

Notice that you're taxed on the paper gain even though you haven't converted any crypto to euros. This creates a potential cash flow challenge: you owe real money on unrealized profits.

The Liquidity Problem: Paying Tax Without Selling

One significant concern with taxing unrealized gains is liquidity. If your entire net worth is locked in cryptocurrency and the value increases substantially, you'll owe taxes without necessarily having cash available to pay them.

This scenario becomes particularly problematic during volatile markets. Imagine your crypto portfolio surges 50% in 2028, generating a large tax bill for that year. If the market crashes in early 2029 before you pay your taxes, you're still liable for the 2028 obligation—even though your portfolio may now be worth less than it was at the start of 2028.

Smart investors should consider several strategies:

Maintain a cash buffer specifically for tax obligations. If you anticipate significant unrealized gains, set aside funds in a liquid account to cover the expected tax bill.

Track values meticulously. You'll need accurate records of your portfolio value on January 1 and December 31 each year. Consider using portfolio tracking tools that can generate year-end snapshots.

Plan strategic sales. If you need to sell assets to pay taxes, timing matters. Selling during favorable market conditions can help you avoid locking in losses while meeting tax obligations.

Comparing the Old and New Systems

| Aspect | Current System (Box 3) | New System (2028+) |

|---|---|---|

| Basis for taxation | Deemed/fictional returns | Actual returns (realized + unrealized) |

| Crypto paper gains | Not directly taxed | Taxed as income |

| Loss treatment | Not recognized | Can carry forward (no refund) |

| Annual exemption | Varies by asset mix | €1,800 flat exemption |

| Legal status | Ruled unlawful by courts | Compliant with property rights |

Record-Keeping and Compliance

The shift to taxing actual returns places greater responsibility on investors to maintain detailed records. The Dutch tax authority will expect you to document:

- Portfolio values on January 1 and December 31

- All transactions throughout the year

- Exchange rates used for euro conversion

- Calculation methodologies for complex assets like staking rewards or liquidity pool tokens

Cryptocurrency exchanges don't always provide tax-ready reports, especially if you use decentralized platforms or hold assets in private wallets. Consider using specialized crypto tax software that integrates with major exchanges and can generate reports compatible with Dutch tax requirements.

Keep transaction records for at least seven years, as this is the standard retention period for tax documentation in the Netherlands.

What You Should Do Now

Although the reform doesn't take effect until 2028, preparation should begin now:

Audit your current portfolio. Know exactly what you hold and where it's located. Consolidating assets into fewer wallets or exchanges simplifies tracking.

Establish a tracking system. Start recording your portfolio value at year-end even before it's required. This creates a baseline and helps you understand your tax exposure.

Consult a tax professional. The intersection of cryptocurrency and Dutch tax law is complex. A specialist can help you navigate the transition and develop strategies to minimize your tax burden legally.

Budget for tax obligations. If you're holding significant unrealized gains, start setting aside funds now. Don't assume you'll sell assets to pay taxes—market conditions may not be favorable when payment is due.

Monitor legislative updates. While the 2028 implementation date is set, details may evolve as the transition approaches. Stay informed through official Belastingdienst communications and reputable tax advisors.

The Broader Context

The Netherlands isn't alone in grappling with crypto taxation. Countries worldwide are developing frameworks to address digital assets, though approaches vary widely. Some jurisdictions only tax realized gains (when you actually sell), while others are considering wealth taxes on holdings.

The Dutch approach of taxing unrealized gains is relatively aggressive compared to many countries, but it aligns with the broader Box 3 philosophy of taxing wealth accumulation. Whether this creates a competitive disadvantage for Dutch crypto investors remains to be seen—it may influence decisions about where crypto-focused businesses and investors choose to locate.

For now, investors in the Netherlands should prepare for a system that treats cryptocurrency gains—paper or realized—as taxable income, with the understanding that careful planning can help manage the financial impact.

Sources

- Belastingdienst (Dutch Tax Authority) - Official guidance on Box 3 taxation

- Dutch Supreme Court ruling (December 2021) on Box 3 wealth tax

- Government of the Netherlands - Tax reform announcements

- Dutch Ministry of Finance - Box 3 reform implementation timeline

- Various Dutch tax advisory publications on cryptocurrency taxation

See you on the other side.

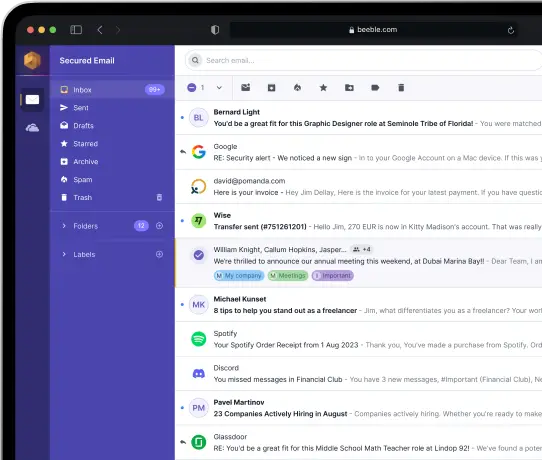

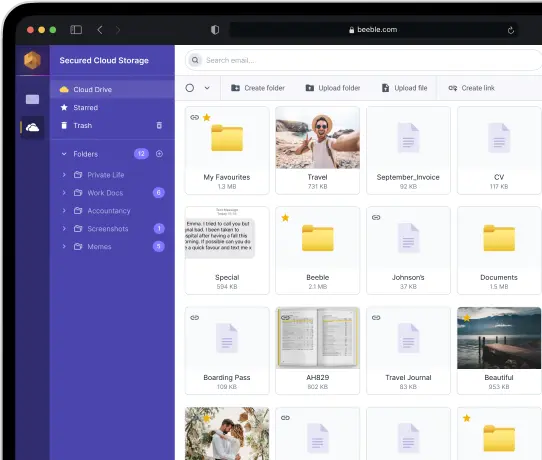

Our end-to-end encrypted email and cloud storage solution provides the most powerful means of secure data exchange, ensuring the safety and privacy of your data.

/ Create a free account